Solar Loan

By far the most common way for most Americans to afford solar. Today’s solar financing is designed to simply be a “bill swap.” Instead of paying ever-increasing rates and an inconsistent monthly bill to a government-sanctioned utility monopoly, you simply make a fixed solar payment every month. A well designed solar system will get you as close to 100% of your power from solar, instead of the grid, thereby reducing what you pay to your utility to the bare minimum “customer charge” which usually ranges between $5 – $15 / month. Then, you pay a fixed solar payment that is often less than what you used to pay for power. On top of that, there’s ZERO dollars down on solar financing, so you’re not out a single penny until weeks after the solar is already on your roof and producing electricity.

Solar Lease

Leases & PPA’s were more common before the financial industry figured out the best way to finance solar ownership. A solar lease is designed a lot like a lease on a car. Theoretically, a lease payment is going to be lower than a solar financing payment, because like an auto lease, a good chunk of the value is tacked onto the backend of the instrument. In theory, you sign a lease on a custom designed solar system for your home, for say 20 years, then at the end of the lease, you either buy it by paying a pre-designated lump sum, or you can elect to have the lease company take the system back at that time. The downside of a lease is that the homeowner does not benefit directly from the 30% federal tax credit – the leasing company claims the credit, then in theory, passes that along to you in the form of savings on your monthly payment.

Power Purchase Agreements

A power purchase agreement is similar to a lease in a lot ways, with a few key differences. First, in a PPA, you’re really not leasing anything. Instead, you’re essentially allowing the PPA provider to set up an electrical substation on your roof that produces power exclusively for you, then they charge you a fixed rate for that power over a set period of time. Like a lease, you don’t own the solar system, but you’re not renting it either. In a PPA arrangement, the means of production just happens to be attached to your roof. A PPA is meant to be a direct alternative to the utility, as you’re simply paying a set per kilowatt hour rate to the PPA company instead of paying a variable rate per kilowatt hour to the utility. Like a lease, once the contracted term is up, you have the option of buying out the system or simply asking the PPA company to take it back, then you presumably go back to buying your power from the grid / utility.

Purchase Outright

They say Cash is King! This is no less true for solar. Paying cash can often earn you a significant discount on the overall cost of the system (sometimes up to 20%). But maybe the biggest benefit of paying cash is that your cost for power monthly is basically $0 – just pay the $5 or $10 bucks / month your utility bills you. A cash purchase also means that you take the entire benefit of the 30% tax credit at the end of the year, resulting in a dollar for dollar reduction in your federal taxes for that year. Most homeowners don’t have the resources to pay cash for solar, but for those who do, this is by far the best long term financing opti.

Our Partners

Paradigm Shift Solar Testimonials

Financing - FAQ

Are there any tax credits for going solar?

Yes. The federal government passed the “Inflation Reduction Act of 2022” around the middle of the year and it provides a 30% tax credit to all new solar customers who qualify. The Solar Investment Tax credit is available to anyone in the USA who pays taxes and purchases their solar system. It’s based on the market value of the system you buy for your home, and is applied to your taxes at the end of the year. For example, if your total solar system cost is $30,000, including all associated financing fees, then your tax credit at the end of the year will be $9,000. It’s important to consult your tax advisor about whether or not you qualify for the tax credit, but the general rule is if you pay taxes, and you’re installing solar on your primary residence, then you qualify.

In addition to the Federal Tax credit, a lot of states and utilities will offer their own credits, incentives or rebates. It varies widely from state to state, which is partly why it is important to work with an experienced solar professional who can guide you through the maze of various incentives that may or may not be available for your home.

Should I lease or buy my solar?

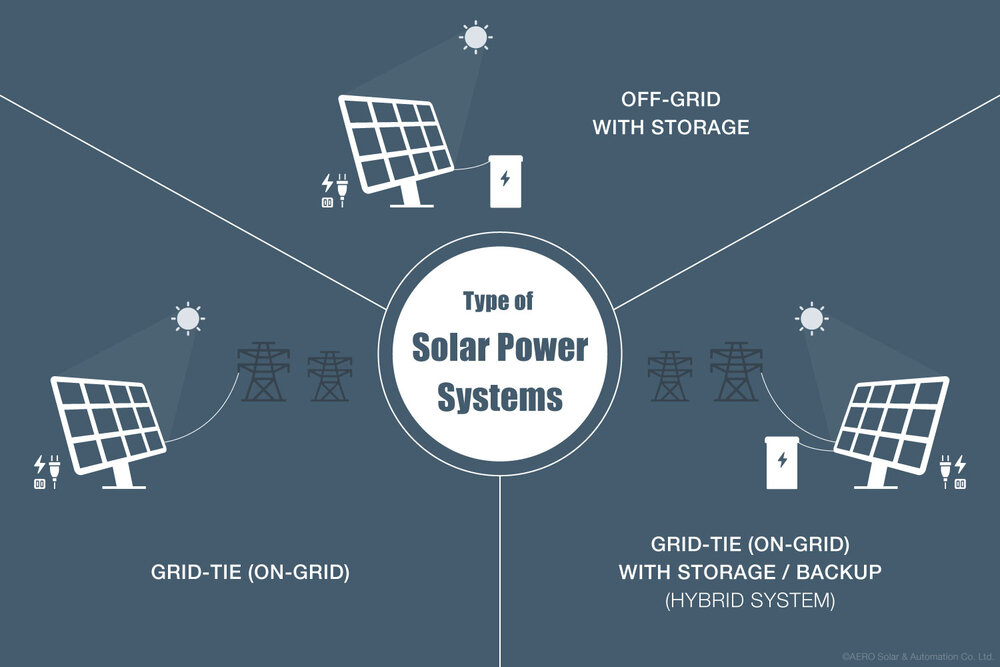

There are basically 3 ways to go solar. You can either buy it, lease it or sign up for a Power Purchase Agreement (PPA). Each option has its own unique benefits that are important to understand as you evaluate which option is best for you.

Leases and PPA’s are similar, and are generally best for those who cannot benefit from the available tax credits either federal or state. For example, retirees often don’t have an income anymore and thus don’t pay any taxes. No tax liability means no 30% federal tax credit. In leases and PPA’s, the company you lease your system from, or buy your solar power from take the tax credit on your behalf and presumably factor that in as savings on your overall ongoing monthly rate that you pay them.

Whenever possible, we always favor buying vs leasing or PPA’s. When you purchase, you get all the tax benefits, all the incentives, all the rebates, all the increased value in your home and unlike a lease or a PPA, come with an end-date. That said, it doesn’t make sense to pay 30% more for a solar system if you can’t qualify for the federal tax credit, so in these cases a lease or a PPA might make sense. Paradigm Shift Solar offers all three options to our customers.

I saw an ad online for FREE solar or a FREE battery, paid for by the government. How do I qualify for one of these programs?

Short answer: you can’t. You can’t because they DO NOT EXIST! There is no such thing as free solar and nobody is going to give you a $15,000 battery out of the goodness of their heart. Period. This is simply a marketing ploy that some unscrupulous solar sales people use as click-bait. Unfortunately, there are a lot of deceptive sales practices across the solar industry, which is why it is so crucial to only work with solar professionals you can trust.

How long is the warranty on my solar system?

This varies based on a number of factors. Most solar installers offer 25 years on panels, 10 years on inverters and 10 years on workmanship and roof penetration. Some installers will expand the inverter warranty all the way up to 25 years, while some others will offer an extended warranty of up to 30 years on everything. The warranty is a crucial part of your solar set-up and a lot of the reason why we formed Paradigm Shift Solar. As solar “advisors”, we work for YOU! That means we will work with you to determine exactly the right warranty for your home, which will ultimately depend on which solar installer we pair you with.

How much does solar cost?

Just like no two solar systems are alike, no two quotes for solar are alike. System costs vary based on many factors including the installer, how many panels you need, the type of inverter we use, whether or not we include a battery or an extended warranty, whether you buy or lease and even where you live, just to name a few. Generally, a minimum-sized system is going to run as low as $15,000, but a very large system on a very large home could top $100,000. More important than cost though, is the savings. Whether you pay $20,000 for your system or $70,000, if it saves you money every single month and you’re not out a penny out of pocket, then overall cost isn’t as much of a factor for most people. The very first step in our process is to get you a comprehensive “Savings Report” which shows you EXACTLY how much money you’ll save every single month, as well as over time going solar.

Solar Blog

Contact

Contact

113 N San Vicente Blvd Suite # 338, Beverly Hills, CA 90211,

United States

Phone: (323) 967-8530

Email: quotes@ps-solar.com

Company and Links

© 2023 Paradigm Shift Solar